Abuja, July 25, 2023 – The Central Bank of Nigeria (CBN) has taken decisive action to combat the surging inflation that has been plaguing the nation by raising its Monetary Policy Rate (MPR) from 18.5 percent to 18.75%. The announcement came after a meeting of the bank’s Monetary Policy Committee (MPC), with Acting CBN Governor, Folashodun Shonubi, leading the discussions.

This move marks the first decision of the monetary committee since President Bola Tinubu assumed office on May 29, 2023. It also marks a significant shift as it is the first time in about a decade that the committee has convened without the presence of Godwin Emefiele, who was suspended as the governor of the apex bank on June 9, 2023.

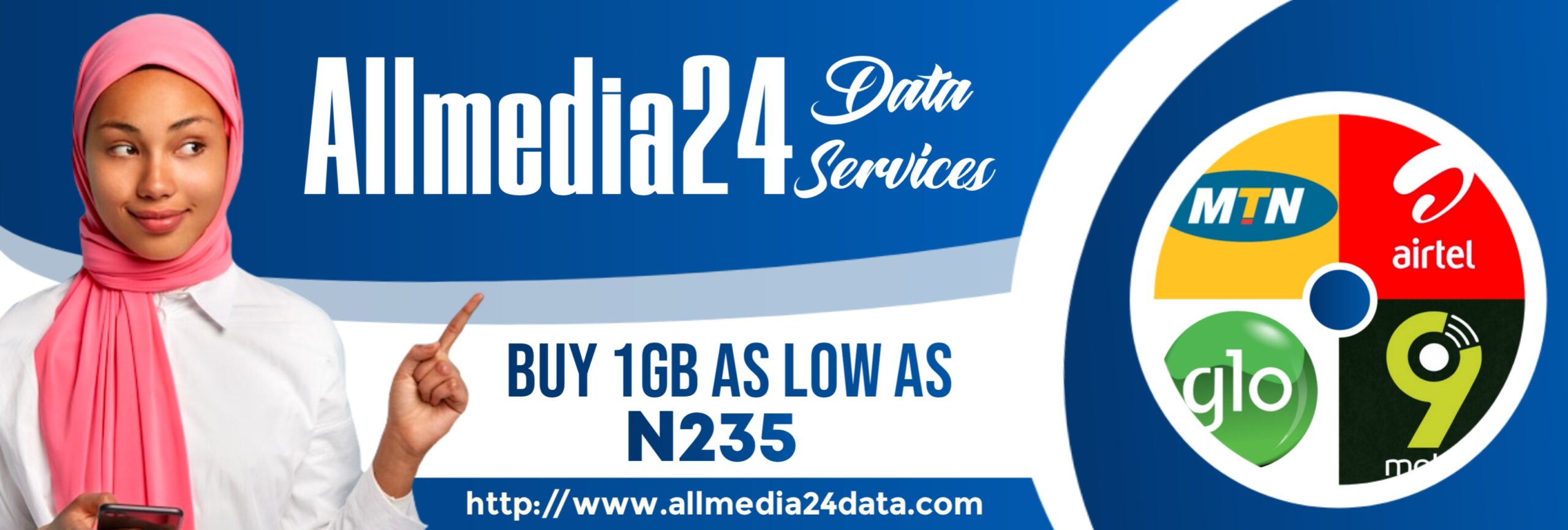

Our Data Prices On JMData:

- MTN SME 1: N255 per 1GB

- MTN SME 2: N259 per 1GB

- Airtel CG: N278 per 1GB

- Glo CG: N230 per 1GB

- 9mobile: N125 per 1GB

Download Our Mobile APP to get started: [JMData] https://play.google.com/store/apps/details?id=com.encrypted.jmdata

HAVE YOU APPLY FOR NIGERIAN CUSTOMS SERVICE RECRUITMENT? GET NIGERIAN CUSTOMS PASS QUESTIONS AND ANSWER PDF FILE BELOW 👇👇👇👇

DOWNLOAD NIGERIAN CUSTOMS RECRUITMENT APTITUDE TEST 2025 PDF

The decision to raise the interest rate comes on the heels of Nigeria’s headline inflation soaring to 22.79% in June, up from 22.41% in May 2023. The steep rise in inflation has been attributed to soaring food prices and the increasing cost of transportation, which has been further exacerbated by the removal of subsidy on Premium Motor Spirit, popularly known as petrol.

The National Bureau of Statistics (NBS), in its latest Consumer Price Index (CPI) report, has indicated that the CPI, which measures the rate of change in prices of goods and services, has been on an alarming upward trend.

Addressing the media at the CBN headquarters in Abuja, Acting Governor Folashodun Shonubi stated that “hiking the interest rate has made a lot of difference in moderating the rate of inflation.” The decision to hike the MPR by 25 basis points to 18.75% from 18.5% was taken in conjunction with narrowing the asymmetric corridor to +100/-300 from +100/-700. Additionally, the committee retained the Cash Reserve Ratio (CRR) at 32.5%.

Furthermore, Shonubi expressed optimism that the volatility surrounding foreign exchange rates would soon stabilize, providing some respite to the country’s economy. This move comes as a response to the challenging economic conditions that have been prevailing in the nation.

With the interest rate adjustment, the CBN aims to rein in inflationary pressures and steer the economy towards a more stable trajectory. While higher interest rates can help curb inflation, they can also have implications for borrowing costs and overall economic activity. As such, the CBN is closely monitoring the situation to strike a balance between controlling inflation and promoting economic growth.

In conclusion, the Central Bank of Nigeria’s decision to raise the interest rate to 18.75% reflects its determination to tackle the persistently high inflation rate that has been impacting the nation’s economy. As the government continues its efforts to stabilize the financial landscape, the road to economic recovery and prosperity remains the focal point of attention.

Source: Channels Television

Dollar to Naira Today Black Market 25 July 2023

JOIN NOW

https://t.me/MidasRWA_bot/app?startapp=ref_5672ba1f-2b27-4c00-884d-27c057e065ac

Google News Channel

Follow us on Google News for Latest Headlines

Join Our WhatsApp, Facebook, or Telegram Group For More News, Click This Link Below;

WhatsApp Channel

https://whatsapp.com/channel/0029VaELqhlHVvTXjDnUf80h

WhatsApp Group

https://chat.whatsapp.com/ICf5K97TqHpHYvwK9Znt3S

Facebook Page

https://facebook.com/allmedia24news

Our Twitter Page

https://www.twitter.com/mubcrypto

Telegram Group

https://www.threads.net/@allmedia24news

Discover more from Allmedia24 News

Subscribe to get the latest posts sent to your email.