On the 20th of July 2023, the unofficial black market exchange rates between the US Dollar (USD) and the Nigerian Naira (NGN) witnessed fluctuations, reflecting the ongoing challenges faced by Nigeria’s currency market. This volatility comes amidst a backdrop of global economic uncertainties and domestic fiscal policies, impacting the Nigerian economy.

As reported by unofficial sources, the buying rate for 1 USD stood at approximately 825 NGN, while the selling rate for the Pound Sterling (GBP) against the Dollar was around 830 NGN. Furthermore, the Euro (EUR) was being bought at roughly 895 NGN and sold at around 910 NGN. The Canadian Dollar (CAD) recorded a buying rate of approximately 695 NGN and a selling rate of 710 NGN, while the South African Rand (ZAR) had a buying rate of about 45 NGN and a selling rate of 53 NGN.

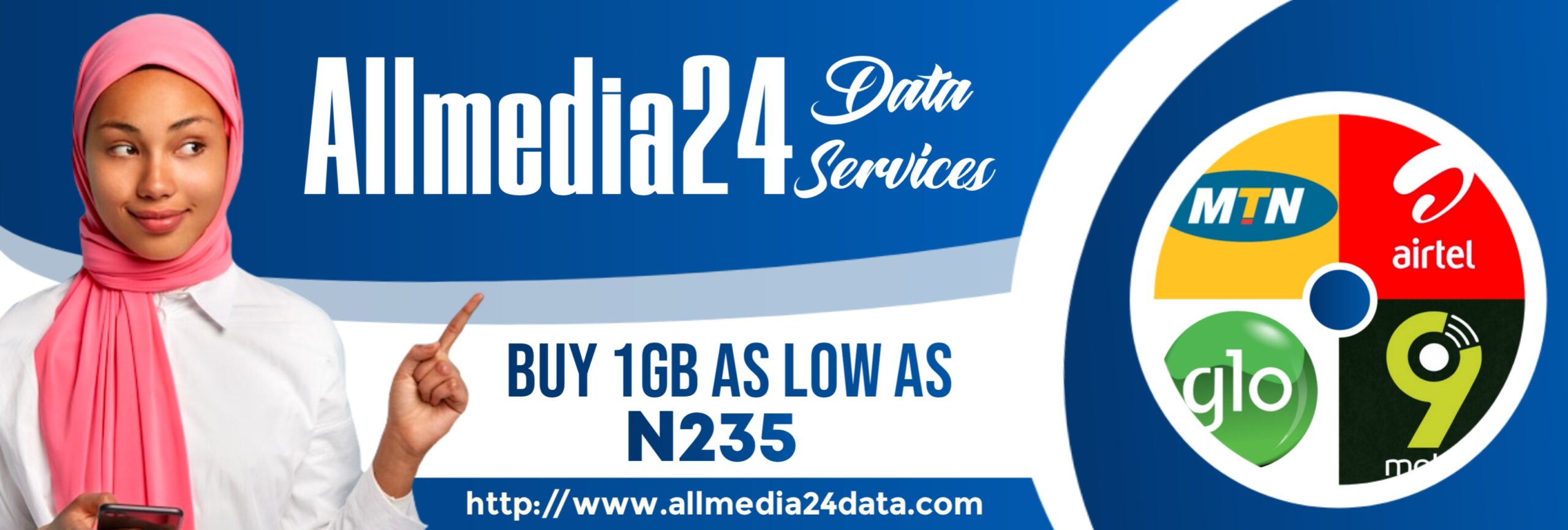

Our Data Prices On JMData:

- MTN SME 1: N255 per 1GB

- MTN SME 2: N259 per 1GB

- Airtel CG: N278 per 1GB

- Glo CG: N230 per 1GB

- 9mobile: N125 per 1GB

Download Our Mobile APP to get started: [JMData] https://play.google.com/store/apps/details?id=com.encrypted.jmdata

HAVE YOU APPLY FOR NIGERIAN CUSTOMS SERVICE RECRUITMENT? GET NIGERIAN CUSTOMS PASS QUESTIONS AND ANSWER PDF FILE BELOW 👇👇👇👇

DOWNLOAD NIGERIAN CUSTOMS RECRUITMENT APTITUDE TEST 2025 PDF

The fluctuations in these exchange rates indicate the challenges faced by Nigeria’s currency market and reflect the broader economic uncertainties that the country has been grappling with in recent times. These unofficial rates may vary significantly from the official rates set by the Central Bank of Nigeria (CBN), contributing to concerns regarding market stability and inflation.

Nigeria has been working to stabilize its economy and mitigate the effects of global economic fluctuations. However, the gap between the official and black market exchange rates remains a concern for policymakers and businesses alike. The disparity can lead to potential arbitrage opportunities and exacerbate the inflationary pressures in the country.

As investors and traders keep a close eye on these developments, the Nigerian government is expected to continue implementing measures to address the challenges posed by the exchange rate volatility. Such measures may include monetary policy adjustments, foreign exchange market interventions, and broader economic reforms aimed at promoting stability and sustainable growth.

It is important to note that these unofficial black market rates are subject to rapid changes due to market dynamics, and individuals and businesses are urged to exercise caution when engaging in foreign currency transactions.

Overall, the fluctuations in the Dollar to Naira exchange rates on the black market highlight the need for a comprehensive and sustainable economic strategy to address the underlying issues facing Nigeria’s currency market. As the country seeks to navigate its way through these challenging times, a concerted effort from policymakers, businesses, and citizens is essential to ensure a stable and prosperous future for Nigeria’s economy.

JOIN NOW

https://t.me/MidasRWA_bot/app?startapp=ref_5672ba1f-2b27-4c00-884d-27c057e065ac

Google News Channel

Follow us on Google News for Latest Headlines

Join Our WhatsApp, Facebook, or Telegram Group For More News, Click This Link Below;

WhatsApp Channel

https://whatsapp.com/channel/0029VaELqhlHVvTXjDnUf80h

WhatsApp Group

https://chat.whatsapp.com/ICf5K97TqHpHYvwK9Znt3S

Facebook Page

https://facebook.com/allmedia24news

Our Twitter Page

https://www.twitter.com/mubcrypto

Telegram Group

https://www.threads.net/@allmedia24news

Discover more from Allmedia24 News

Subscribe to get the latest posts sent to your email.

Pingback: URGENT: Fuel Purchase Drops by Half! IPMAN Pleads with Tinubu to Slash Pump Prices - Allmedia24 News

Pingback: Dollar to Naira Black Market Today 22nd July 2023: Aboki Forex Rates Unveiled! - Allmedia24 News