The Nigerian naira is bracing for further depreciation as Brent crude oil prices have fallen below $70 per barrel for the first time since December 2021. This decline comes amid growing concerns over global economic slowdown and oil demand.

The significant drop in oil prices has already impacted the naira, which recently weakened to N1,600 per US dollar, worsening Nigeria’s currency crisis. As one of the country’s main revenue sources, the decline in oil prices poses an additional challenge for its already strained economy.

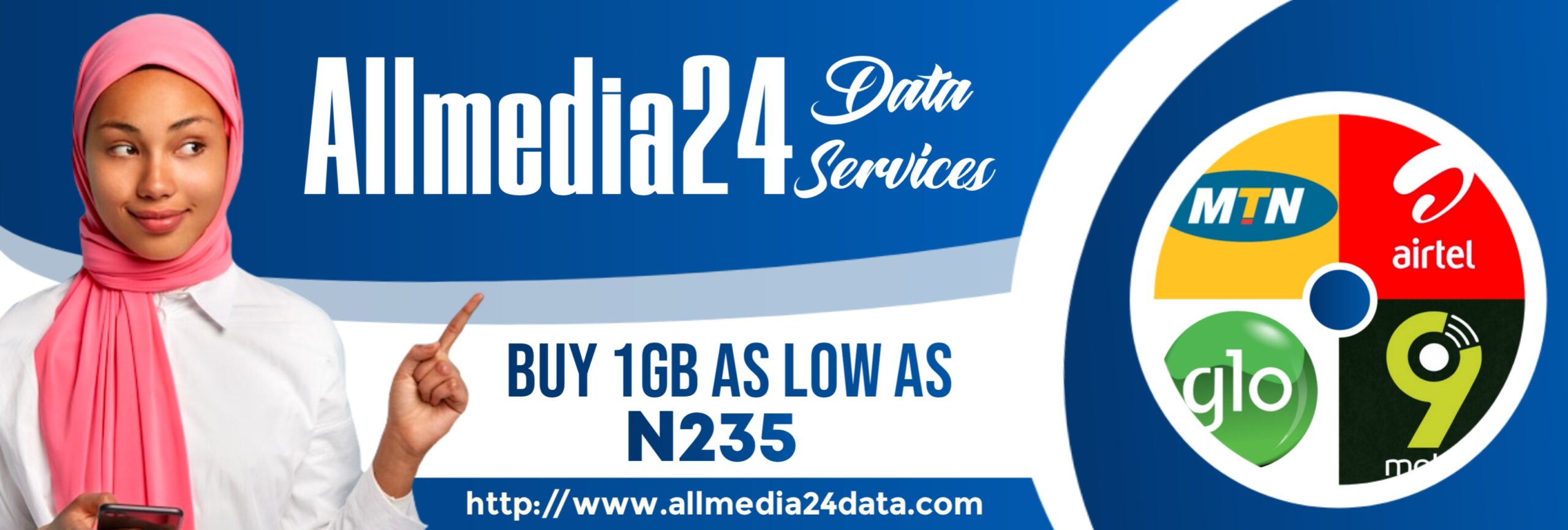

Our Data Prices On JMData:

- MTN SME 1: N255 per 1GB

- MTN SME 2: N259 per 1GB

- Airtel CG: N278 per 1GB

- Glo CG: N230 per 1GB

- 9mobile: N125 per 1GB

Download Our Mobile APP to get started: [JMData] https://play.google.com/store/apps/details?id=com.encrypted.jmdata

HAVE YOU APPLY FOR NIGERIAN CUSTOMS SERVICE RECRUITMENT? GET NIGERIAN CUSTOMS PASS QUESTIONS AND ANSWER PDF FILE BELOW 👇👇👇👇

DOWNLOAD NIGERIAN CUSTOMS RECRUITMENT APTITUDE TEST 2025 PDF

Analysts have pointed to several factors behind the oil price drop, including a downward revision of demand estimates by OPEC, although the organization’s changes were minor. Tamas Varga, an oil analyst at PVM Oil Associates, cited Chinese economic challenges and a stronger belief that the US Federal Reserve will cut interest rates by only 0.25% as key reasons for the sell-off.

Chinese oil imports in August dropped by 7% year-on-year, reflecting the nation’s sluggish recovery, further contributing to downward pressure on oil prices. Even with OPEC+ maintaining its production levels and potential interest rate cuts in sight, oil bulls are hesitating to counter the broader market trend.

In the US, stock markets have shown mixed results, with investor focus on upcoming inflation data and decisions from the Federal Reserve. Disappointing jobs data also reignited fears that the Fed’s delayed action on interest rates could lead to a recession. While there was some recovery in the markets, momentum appeared to wane by Tuesday.

Traders are also closely following the political scene in the US, with key moments such as the upcoming debate between Kamala Harris and Donald Trump, ahead of the 2024 presidential election, being closely watched. Investors are awaiting critical inflation figures, expected to be released on Wednesday, which could further impact sentiment.

The Federal Reserve is anticipated to reduce interest rates at its next meeting, but the extent of the cut remains uncertain. Speculation persists as to whether it will be a 25 or 50 basis point reduction, with larger cuts potentially signaling deeper concerns about the state of the economy.

As oil prices remain under pressure, global economic uncertainty continues to weigh heavily on commodity markets, adding strain to oil-dependent economies like Nigeria.

JOIN NOW

https://t.me/MidasRWA_bot/app?startapp=ref_5672ba1f-2b27-4c00-884d-27c057e065ac

Google News Channel

Follow us on Google News for Latest Headlines

Join Our WhatsApp, Facebook, or Telegram Group For More News, Click This Link Below;

WhatsApp Channel

https://whatsapp.com/channel/0029VaELqhlHVvTXjDnUf80h

WhatsApp Group

https://chat.whatsapp.com/ICf5K97TqHpHYvwK9Znt3S

Facebook Page

https://facebook.com/allmedia24news

Our Twitter Page

https://www.twitter.com/mubcrypto

Telegram Group

https://www.threads.net/@allmedia24news

Discover more from Allmedia24 News

Subscribe to get the latest posts sent to your email.