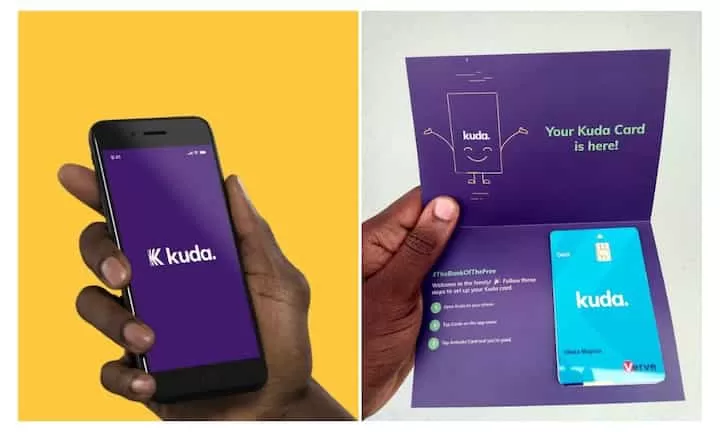

Nigeria’s first digital bank, Kuda, has launched a new feature called SoftPoS that will allow customers to accept contactless card payments using their smartphones or tablets. This latest innovation is a part of Kuda’s Business app, which includes other features such as Sales Mode, Kuda Payroll, and business registration. The SoftPoS feature will allow customers to use their smartphones or tablets as secure payment terminals or Point of Sale (PoS) machines.

Customers will be able to accept payments using plastic or virtual cards, and the feature runs on Android version 8.0 or higher with an NFC module. The SoftPoS feature is expected to be a game-changer in the Nigerian banking industry, making it easier and more convenient for businesses to accept card payments without the need for expensive PoS machines.

Our Data Prices on JMDATA:

- MTN SME 1: N255 per 1GB

- MTN Corporate: N259 per 1GB

- Airtel CG: N278 per 1GB

- Glo CG: N230 per 1GB

- 9mobile: N125 per 1GB

Download Our Mobile APP to get started: https://play.google.com/store/apps/details?id=com.encrypted.jmdata

However, Kuda Bank has also announced that it will be ending its iconic 25 free monthly transfers to any bank for Business Account holders, effective March 17, 2023. The bank stated that it will charge a flat rate of N10 per transfer to any bank, allowing customers to save about N15,000 yearly. This move may come as a disappointment to some customers, but it is essential for the bank to maintain its financial stability while providing top-notch services to its customers.

Kuda Bank has been making waves in the Nigerian banking industry since its launch in 2019. The bank introduced 25 free monthly transfers to any bank in the same year, and last year it announced that it would start charging N50 Stamp Duty on all deposits above N10,000 weekly. In November 2022, Kuda Bank raised about $10 million in seed funding, which is touted as the most significant seed round by an African startup. The funding is part of the bank’s effort to position itself as the go-to bank for Africans both at home and abroad.

Finally, the Kuda Bank’s new SoftPoS feature is a significant development in the Nigerian banking industry, making it easier for businesses to accept card payments. However, the end of the 25 free monthly transfers to any bank may come as a disappointment to some customers, but it is necessary for the bank’s financial stability. Kuda Bank’s efforts to position itself as the go-to bank for Africans both at home and abroad are commendable, and we can expect more innovative features and services from the bank in the future.

You can download the Kuda SoftPOS HERE to start making money with it.

Source: https://www.legit.ng

Join Our WhatsApp Group For More News, Click This Link Below;

https://chat.whatsapp.com/BRg2MLrPwUgH8t7YwMNOTm

Follow us on Google News for Latest Headlines

Join Our WhatsApp, Facebook, or Telegram Group For More News, Click This Link Below;

WhatsApp Channel

https://whatsapp.com/channel/0029VaELqhlHVvTXjDnUf80h

WhatsApp Group

https://chat.whatsapp.com/C6C3F5tXtKE8SUuJUO78KA

Facebook Page

https://facebook.com/allmedia24news

Our Twitter Page

https://www.twitter.com/allmedia24news

Telegram Group

https://www.threads.net/@allmedia24news

Pingback: How to Make Money with a POS Business in Nigeria: Tips and Strategies - Allmedia24 News

Pingback: Tecno unveils Spark 10 Pro with 6.8" 90Hz display and glass rear - Allmedia24 News

Pingback: Global Bank Stocks Drop Despite Biden's Assurances After Silicon Valley Bank and Signature Bank Collapse - Allmedia24 News